How To Withdraw Money From Crypto.com

Whether withdrawing $100 or $1 million, Crypto.com offers flexible options for users to access their funds. Learning how to withdraw money from Crypto.com is essential for anyone looking to convert their crypto investments into usable cash or transfer assets to external wallets.

The platform processes most withdrawals within 2-3 hours and supports multiple withdrawal methods, including bank transfers, credit cards, and digital money payment solutions like Apple Pay and Google Pay. Users can withdraw up to $100,000 per day and $500,000 monthly without fees, while Prime users enjoy even higher limits of $1 million daily. For those wondering how to withdraw money from Crypto.com UK and other regions, the platform supports various currencies, including USD, EUR, and GBP.

Want to cash out your Crypto.com funds in 2025? We’ve got you covered! This guide walks you through the exact steps, requirements, and best practices to withdraw your money safely and hassle-free.

Contents

- 1 Crypto.com Withdrawal Options Explained

- 2 How to Withdraw Money from Crypto.com to Your Bank

- 3 How to Withdraw Money from Crypto.com to External Wallets

- 4 Common Withdrawal Issues and Solutions

- 5 Smart Withdrawal Strategies for 2025: How to Withdraw Money from Crypto.com Efficiently

- 6 How To Withdraw Money From Crypto.com Frequently Asked Questions

- 6.1 What are the withdrawal options available on Crypto.com?

- 6.2 How to withdraw my money from Crypto.com?

- 6.3 How to withdraw money from Crypto.com to bank account?

- 6.4 How to withdraw money from Crypto.com Visa card?

- 6.5 How to withdraw money from Crypto.com app?

- 6.6 How long does it take to process a withdrawal from Crypto.com?

- 6.7 Are there any withdrawal limits on Crypto.com?

- 6.8 What security measures does Crypto.com implement for withdrawals?

- 6.9 How can I optimize my withdrawals from Crypto.com in 2025?

Crypto.com Withdrawal Options Explained

Crypto.com provides multiple pathways for users to access their funds through both fiat and cryptocurrency withdrawals. Each method comes with specific requirements, limits, and processing times that users should understand before initiating transactions.

Different ways to withdraw money from Crypto.com

The platform supports eight major fiat currencies for withdrawals, specifically AUD, CAD, EUR, GBP, USD, BRL, TRY, and SGD. For fiat withdrawals, users must first convert their cryptocurrency to their desired currency through the app. Subsequently, they can transfer funds to their linked bank accounts using various payment networks:

- ACH transfers for USD withdrawals

- SEPA network for EUR transactions

- FPS system for GBP transfers

Furthermore, users can withdraw cryptocurrency directly to external wallets or other exchanges, offering additional flexibility for managing digital assets.

Withdrawal limits and fees

The withdrawal structure varies based on the chosen method and user tier. For ACH transfers in USD:

- Minimum transaction amount: $100

- Daily limit: $100,000 (standard users)

- Monthly limit: $500,000 or 30 transactions

- Prime users enjoy elevated limits of $1 million per day

For cryptocurrency withdrawals, the platform implements a rolling 24-hour maximum limit equivalent to 10 BTC. Additionally, users should note:

- EUR withdrawals through SEPA incur a €1.00 fee per transaction

- GBP withdrawals via FPS come with a £1.90 fee per transfer

- Cryptocurrency withdrawal fees vary by asset and are deducted from the withdrawal amount

Processing times for each method

The processing duration depends on the chosen withdrawal method. For cryptocurrency transfers:

- BTC withdrawals typically complete within 2 hours

- ETH and ERC-20 token transfers process within 2 hours

- Transfers to external wallets generally take 2-3 hours

- Withdrawals to other Crypto.com App users process instantly

For fiat withdrawals, processing times vary by region and payment network. Bank transfers usually complete within one business day. Moreover, the platform implements security measures such as:

- 24-hour withdrawal locks on newly added external wallet addresses

- Mandatory withdrawal address whitelisting

- Email confirmations for withdrawal requests

Before initiating how to withdraw money from Crypto.com, users must complete identity verification and, for certain regions, demonstrate successful prior deposits. For instance, EUR withdrawals require at least one successful SEPA deposit beforehand. The platform also maintains strict security protocols, particularly for the Crypto.com Exchange, where withdrawals are exclusively permitted from master accounts rather than sub-accounts.

How to Withdraw Money from Crypto.com to Your Bank

Transferring funds from Crypto.com to a bank account requires proper verification and following specific steps. Understanding how to withdraw money from Crypto.com starts with setting up the right banking connections and following security protocols.

Setting up bank account verification

The first step in learning how to withdraw money from Crypto.com involves linking and verifying a bank account. Users must complete these essential steps:

- Access the Plaid integration through “Deposit > Cash > USD > Instant deposit > Add Bank account”

- Select the preferred banking institution

- Log into the banking portal securely

- Authorize the connection between the bank and Crypto.com

One crucial requirement remains consistent across regions – the bank account name must match exactly with the name associated with the Crypto.com account. Users can connect up to five different bank accounts simultaneously through the ACH network.

For European users wondering how to withdraw money from Crypto.com UK and other EU regions, a successful SEPA deposit must be completed initially. Similarly, GBP withdrawals require a prior successful FPS deposit.

Step-by-step withdrawal process

Once bank verification is complete, initiating a withdrawal follows this sequence:

- Navigate to the Accounts section in the app

- Select the appropriate fiat wallet

- Choose “Transfer” followed by “Withdraw”

- Input the desired withdrawal amount

- Select the verified bank account for the transfer

- Review and confirm the transaction details

The platform implements several security measures during withdrawals. Users must complete verification through either:

- Passkey authentication if configured

- Two-factor authentication combined with SMS verification

Processing times vary based on the chosen withdrawal method. Standard bank transfers typically complete within one business day. Nevertheless, certain factors might affect processing duration:

- Bank processing schedules

- Network congestion

- Security verification requirements

- Regional banking regulations

The platform maintains strict withdrawal limits to ensure security. For standard ACH transfers:

- Minimum withdrawal: $100 per transaction

- Daily maximum: $100,000

- Monthly ceiling: $500,000 or 30 transactions

Prime users receive elevated privileges with daily withdrawal limits reaching $1 million. Consequently, users should consider these limitations when planning large transfers.

For enhanced security, Crypto.com recommends enabling the 24-hour withdrawal lock feature. Furthermore, the platform sends confirmation emails for each withdrawal request, allowing users to track their transactions effectively.

If withdrawal issues arise, common solutions include:

- Verifying bank account details accuracy

- Ensuring sufficient account balance

- Confirming compliance with regional regulations

- Checking withdrawal limit thresholds

How to Withdraw Money from Crypto.com to External Wallets

Moving digital assets from Crypto.com to external wallets requires careful attention to security protocols and network compatibility. Furthermore, learning how to withdraw money from Crypto.com through cryptocurrency transfers involves understanding wallet setup, verification processes, and network selection. Consequently, following the correct steps ensures a smooth and secure transaction.

Setting up external wallet addresses

The platform first implements a mandatory whitelisting system for external wallet addresses. Before proceeding, users must add their destination wallet to the whitelist. To begin, follow these steps to withdraw money from Crypto.com:

- Access the Accounts section and select Crypto Wallet

- Navigate to Transfer > Withdraw > External Wallet

- Select “+ Add Wallet Address” or tap the “+” icon

- Choose the cryptocurrency and network

- Enter or scan the withdrawal address QR code

- Assign a recognizable name to the wallet

Each wallet created or imported maintains its unique recovery phrase, thereby ensuring separate security for different asset holdings. Additionally, users can personalize wallet names without limitations, making it easier to identify multiple withdrawal destinations.

Security verification steps

Crypto.com employs multi-layered security measures for cryptocurrency withdrawals. Upon adding a new withdrawal address, users encounter:

- SMS verification code requirement

- Two-factor authentication through an authenticator app

- 24-hour withdrawal lock for newly whitelisted addresses

The 24-hour withdrawal lock serves as a protective measure, allowing users time to secure their accounts if compromised. For enhanced protection, the platform sends confirmation emails for every withdrawal request. Users wondering how to withdraw money from Crypto.com UK and other regions must complete comprehensive identity verification before accessing withdrawal features.

Network selection tips

Selecting the correct network proves crucial for successful withdrawals. The platform supports multiple networks for various cryptocurrencies, including:

- Bitcoin (BTC): Bitcoin mainnet

- Ethereum-based tokens: ERC-20 network

- Native networks for Litecoin, Cardano, Solana, and other major cryptocurrencies

Notably, users must ensure network compatibility between source and destination wallets. For instance, ERC-20 tokens require withdrawal to ERC-20-compatible addresses exclusively. Sending assets through incompatible networks results in permanent loss of funds.

Processing times vary based on network selection:

- Most cryptocurrency withdrawals complete within 2-3 hours

- Transfers to other Crypto.com users process instantly

- External wallet transfers might require additional confirmation time depending on network congestion

The platform maintains strict security protocols, particularly for exchange withdrawals. Users should note that withdrawals from the Crypto.com Exchange are permitted solely from master accounts. Furthermore, the system implements rolling 24-hour withdrawal limits equivalent to 10 BTC to maintain security standards.

For optimal transaction success, users should:

- Verify network compatibility before initiating transfers

- Double-check destination addresses

- Consider network fees when determining withdrawal amounts

- Monitor transaction status through blockchain explorers

Common Withdrawal Issues and Solutions

Users encountering difficulties with withdrawing money from Crypto.com may, at times, face several common obstacles. Therefore, understanding these issues and their solutions ultimately helps ensure smooth transactions.

Failed transaction troubleshooting

Learning how to withdraw money from Crypto.com requires attention to detail, as transactions might fail due to various reasons. Name mismatches between bank accounts and Crypto.com profiles stand as a primary cause, often resulting in rejected transfers and potential refund fees.

First thing to remember, users must maintain sufficient balance to cover both the withdrawal amount and associated transaction fees. Secondly, blockchain network congestion can cause delays or rejections, especially during peak trading periods.

For cryptocurrency withdrawals, these common issues arise:

- Incorrect wallet addresses or network selection

- Insufficient funds for transaction fees

- Withdrawals during system maintenance periods

- Exceeding daily or monthly limits

Account verification problems

Understanding how to withdraw money from Crypto.com UK and other regions begins with proper account verification. Furthermore, the platform implements strict Know Your Customer (KYC) protocols, requiring users to submit essential documents.

- Government-issued identification

- Proof of address

- Clear photo verification

Verification status updates typically process within three business days. However, certain factors might extend this timeline:

- Quality of submitted documents

- Country of application

- Nationality requirements

- Peak verification periods

In cases where verification remains pending beyond three business days, users should contact support through the official chat channel. The platform explicitly warns against sending unrequested personal information or documentation.

Bank transfer delays

Bank transfer processing times vary based on multiple factors. Standard withdrawals typically complete within 1-5 business days. Nevertheless, several circumstances might extend these timeframes:

Intra-bank and FAST transfers process near-instantly, whereas transfers exceeding FAST limits route through EFT, processing only during banking hours. Deposits made outside operating hours credit the next business day.

To minimize delays when learning how to withdraw money from Crypto.com, users should verify:

- The sending bank belongs to supported networks

- Personal account details match exactly

- Reference numbers are correctly entered

- Joint accounts are avoided for transfers

The platform maintains specific withdrawal limits:

- Daily limit: 150,000 TRY

- Monthly limit: 1,000,000 TRY

Throughout 2025, scheduled maintenance periods might temporarily affect withdrawal services. Therefore, users should monitor platform announcements regarding:

- Fiat wallet availability

- ACH transfer processing

- External wallet transfers

- Bank transfer processing times

Smart Withdrawal Strategies for 2025: How to Withdraw Money from Crypto.com Efficiently

Planning a strategic approach is crucial for anyone learning how to withdraw money from Crypto.com in 2025. Moreover, with significant changes in cryptocurrency regulations and tax requirements, users must therefore consider several factors to optimize their withdrawals.

Tax considerations

Starting January 2025, cryptocurrency exchanges must track transactions and report them on Form 1099-DA, a new tax form designed specifically for digital assets. Understanding these tax implications helps users make informed decisions about how to withdraw money from Crypto.com UK and other regions.

The tax rates for cryptocurrency withdrawals depend on holding periods:

- Short-term gains (assets held ≤ 1 year): Regular income tax rates between 10-37%

- Long-term gains (assets held > 1 year): Reduced rates of 0-20% based on income level

Starting in January 2025, users must transition to a wallet-by-wallet accounting method instead of the universally allowed approach. Consequently, this change requires allocating costs across specific wallets by December 31, 2024. To ease this transition, the IRS offers Safe Harbor relief through Revenue Procedure 2024-28, thereby allowing a reasonable allocation of high-basis and low-basis units across wallets.

Timing your withdrawals

Strategic timing of withdrawals can significantly impact tax obligations and transaction costs. For optimal results when learning how to withdraw money from Crypto.com, consider these proven strategies:

Firstly, consolidating withdrawals helps minimize transaction fees. Instead of multiple small withdrawals, combining them into larger transactions reduces overall costs.

Accordingly, users should consider their income fluctuations when planning withdrawals. Making withdrawals during lower-income years can result in reduced tax rates. In contrast, those anticipating higher future income might benefit from accelerating gains to secure current lower capital gains rates.

For users approaching the one-year holding period threshold, borrowing from liquidity pools presents an alternative to immediate withdrawal. This approach helps reach the long-term capital gains qualification while maintaining access to funds.

Throughout 2025, users should maintain detailed records of:

- Purchase dates and prices

- Sale amounts and dates

- Wallet-specific transaction details

- Network fees and other costs

Most importantly, the platform processes withdrawals within 2-3 hours, allowing users to manage their transactions more efficiently. Furthermore, prime users enjoy elevated withdrawal limits of up to $1 million daily, thereby offering greater flexibility for larger transactions.

How To Withdraw Money From Crypto.com Frequently Asked Questions

What are the withdrawal options available on Crypto.com?

Crypto.com offers multiple withdrawal methods, including bank transfers, cryptocurrency transfers to external wallets, and digital payment solutions like Apple Pay and Google Pay. The platform supports withdrawals in various fiat currencies such as USD, EUR, and GBP.

How to withdraw my money from Crypto.com?

You can withdraw money from Crypto.com by transferring fiat to your linked bank account or sending crypto to an external wallet. Go to “Transfer,” select “Withdraw,” enter the details, and confirm. Processing times depend on the withdrawal method.

How to withdraw money from Crypto.com to bank account?

To withdraw funds from Crypto.com to your bank, go to the app, select “Transfer,” then “Withdraw,” and choose “Fiat.” Enter the amount, select your linked bank account, and confirm the transaction. Processing times vary depending on your bank.

How to withdraw money from Crypto.com Visa card?

You cannot withdraw cash directly from the Crypto.com Visa card to a bank. However, you can use the card to withdraw cash from an ATM, spend it at merchants, or transfer funds to another account before withdrawing.

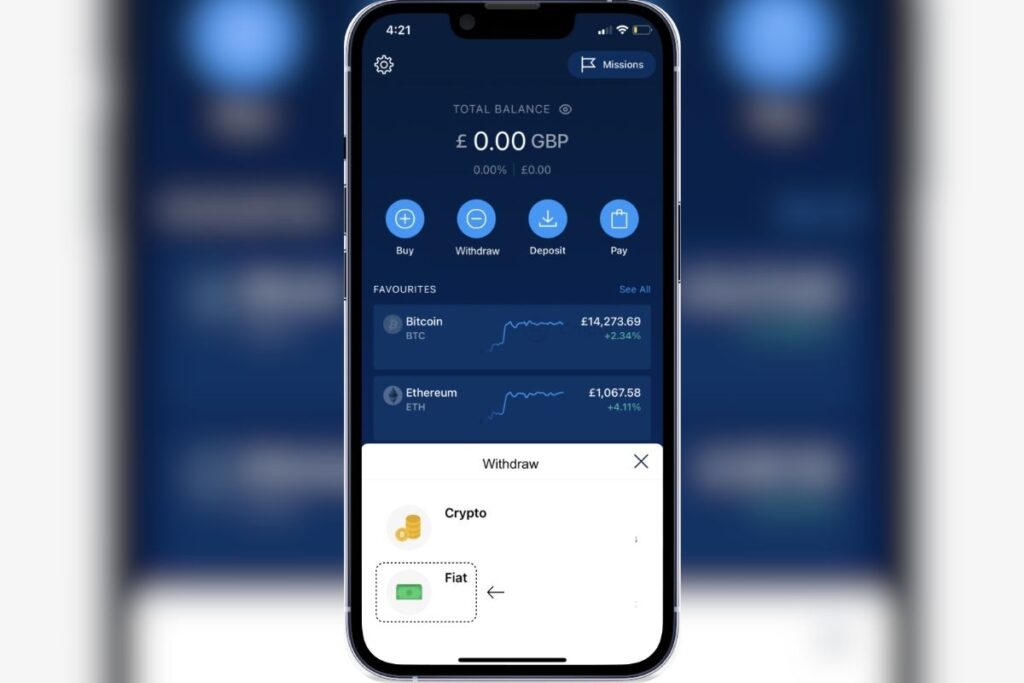

How to withdraw money from Crypto.com app?

To withdraw money from the Crypto.com app, select “Transfer,” choose “Withdraw,” and pick either “Crypto” or “Fiat.” For fiat, link your bank account and follow the prompts. Crypto withdrawals require a verified wallet address.

How long does it take to process a withdrawal from Crypto.com?

Most withdrawals on Crypto.com are processed within 2-3 hours. However, the exact processing time can vary depending on the withdrawal method. Cryptocurrency transfers to external wallets typically complete within 2-3 hours, while bank transfers may take 1-5 business days.

Are there any withdrawal limits on Crypto.com?

Yes, Crypto.com imposes withdrawal limits. Standard users can withdraw up to $100,000 per day and $500,000 monthly without fees. Prime users enjoy higher limits of up to $1 million daily. For cryptocurrency withdrawals, there’s a rolling 24-hour maximum limit equivalent to 10 BTC.

What security measures does Crypto.com implement for withdrawals?

Crypto.com employs several security measures for withdrawals, including two-factor authentication, SMS verification, mandatory withdrawal address whitelisting, and a 24-hour withdrawal lock on newly added external wallet addresses. The platform also sends confirmation emails for each withdrawal request.

How can I optimize my withdrawals from Crypto.com in 2025?

To optimize withdrawals in 2025, first, consider consolidating transactions to minimize fees. Additionally, time your withdrawals based on income fluctuations to maximize tax benefits. Furthermore, maintain detailed records of all transactions for better financial tracking. Moreover, be aware of the new wallet-by-wallet accounting method for taxes. Finally, consider the holding period of your assets to potentially benefit from long-term capital gains rates.